CPA Canada

Chartered Professional Accountants of Canada (CPA Canada) is one of the largest national accounting organizations in the world, representing some 220,000 CPAs at the national and international levels.

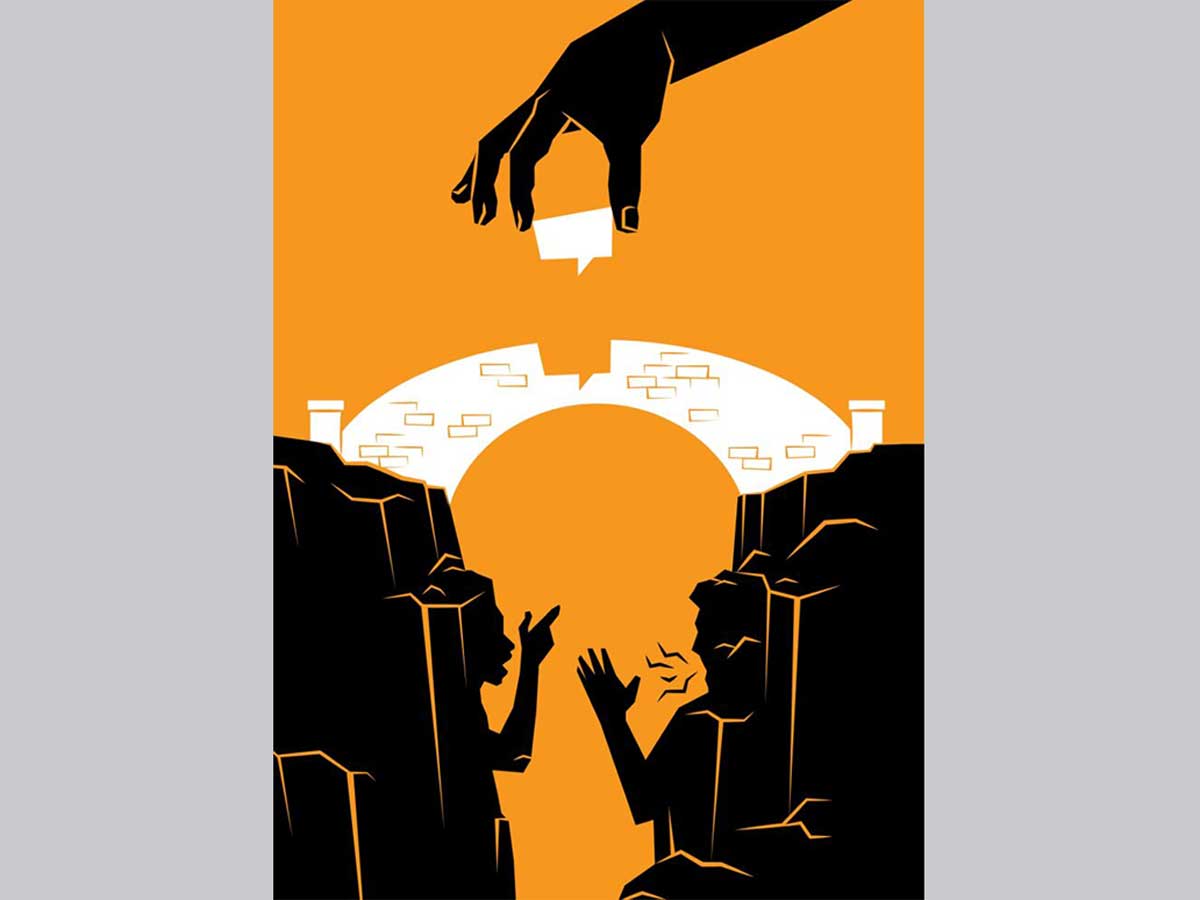

A path forward for the profession: Your questions answered

Many members have contacted CPA Canada about the future of the profession following announcements by CPA Ontario and the Ordre des CPA du Québec that they intend to withdraw from the Collaboration Accord. Here are some frequently asked questions.

CRA exempts bare trusts from reporting requirements after CPA Canada raises concerns

Learn more about CPA Canada

As Canada’s national accounting body, we support, empower and advocate for members and the profession on the national and international stages.

Budget 2024 leaves the feds in an unenviable position

A slowing economy, lower revenues and high financing costs are all working in concert to create a situation where tough choices will be necessary for the April 16 budget

Stay informed on developments at CPA Canada

CPA Canada is committed to working collaboratively with all members, partners and stakeholders to improve and sustain our profession. Sign up for updates and opportunities to engage with us.

CPA Canada member benefits

CPA Canada member benefits: Take advantage of savings, professional development and more.